To allow for more growth opportunities, accounting and finance teams must work together to explore 'creative' accounting systems that shift current assets around. Depending on the techniques used, some methods are merely exploiting legal loopholes. Others toe the line between 'creative' and downright fraudulent. Far more often, though, an inflated accounts payable balance sheet results from incongruities in record-keeping and inefficient accounting systems.

Regardless of the underlying cause or intent, the bottom line is this: if your company's balance sheet is not portraying an accurate picture, you're shooting in the dark. Your finance team can't turn insights into action if the big picture is incomplete. When your business isn't growing, it's stagnating. To help you avoid this potentially lethal pitfall, we're going to dive into an in-depth exploration of:

- How to recognize inflation on your balance sheets

- How errors and different regulations can cause inflation

- The business risks of inflation

- How Order.co can help solve inflated financial statements.

Recognizing inflated financial statement

As an equity shareholder or potential investor, understanding how to recognize inflated balance sheets is an invaluable bit of knowledge. The formula for calculating the inflated percentage is:

Inflation Level = (Goodwill - Brand Value) / Brand Value

Goodwill assets

Goodwill assets are usually the result of a company acquiring another business. Businesses consider them intangible assets under the long-term asset account. If the acquiring company pays more than the company's fair value, that is the target company's goodwill value. However, if the acquiring company pays less than the fair value, it has 'negative goodwill.'

Brand value

Simply put, the brand value is the purchase or replacement value of a brand. There are several ways to approach calculating brand value, which leads to it being a highly speculative figure. Regardless of the technique used, your accounts payable, accounts receivable, cash flow, long-term debt, short-term debt, and company assets will be examined in-depth. From there, analysts will apply various financial ratios and compare the results to your competitors.

Corporations with inflated balance sheets

It's a surprisingly common practice for mega-corporations to use legal loopholes to inflate their balance sheets. For example, Tesla recently came under fire from critics when their accounts payable and other short-term liabilities ballooned to more than $3 billion. That's an increase of $425 million from Q1 of 2020. By increasing the amount it owed to its suppliers, Tesla was able to show a higher cash account balance and push forward with larger projects.

Sometimes, entire industries are notorious for inflating balance sheets. One such industry is banking. Unlike their tech or pharmaceutical counterparts who have high-valued intangible assets that make them unique, the banking industry is a near-perfect competitive environment. Many people point to Bank of America when examining the banking industry and this practice.

Ways an accounts payable balance sheet can be inflated

Theoretically, there are countless ways to manipulate a company's assets. However, there are two ways that are the most common. The first is exaggerate earnings on the income statement. This is done by inflating the current period's revenue and cash flow, deflating expenses, or both. The second is the exact opposite of the first. A company's revenue is deflated, and the expenses are inflated.

Those approaches are examples of purposeful, legal manipulation to frame a company's total assets over a period of time in the desired way to attract investors and appease shareholders. But other ways that a company's financial statements can be inflated have less to do with framing and more to do with circumstance.

Changing regulations and standards

In 2016, the Financial Accounting Standards Board updated its lease accounting standards. Under the new standards, companies must record leases of more than 12 months for property or equipment on their balance sheets and liabilities. Previously, GAAP-accepted standards allowed leases to be classified as financing or operating leases. Only capital leases were required to be recognized on balance sheets.

Now, both types of leases are required to be recognized. This change means that the balance sheets of some companies will show inflated assets and liabilities but without any real change in their equity.

Errors in the accounts payable balance sheet

This is the most common reason for an inability to see a company's assets clearly. Errors involving transposed numbers in accounts payable, accounts receivable, or the general ledger can snowball quickly, leading to long-term problems. Often, data is misclassified; common instances include confusing long-term liabilities with short-term liabilities and vice versa.

For companies that lack a consistent accounting system, errors of omission are the most common problem. Take, for example, the case of BlankSpaces. As this small business expanded into new locations, their processes became much more chaotic as each new location had separate purchasing processes. This led to purchases of office supplies being lost or never recorded and other accounting inconsistencies. Each location had a separate credit card for purchases, and far too often, purchases were entered under the wrong credit card.

All the chaos meant their accounts payable balance sheet was consistently incorrect, inflated in some areas, and deflated. BlankSpaces is not alone when it comes to this type of stumbling block. Luckily, their AP department realized quickly that they were headed for disaster if they didn't find a way to shape all locations into a more cohesive unit.

With Order.co, they could eliminate using multiple credit cards and consolidate all accounts payable under one umbrella. Additionally, because Order.co has already established partnerships, they're saving additional time and money by not dealing with annual memberships.

Risks associated with inflated financial statements

There are a plethora of issues that can result from inaccurate bookkeeping and a bad account payable balance sheet. An inflated income statement may help in one area but lead to higher taxes, thereby canceling any perceived benefit. An accurate reflection of your current assets, accounts payable, and accounts receivable plays a fundamental role in forecasting, budgeting, and developing key performance indicators. But there is much more risk involved when your company's balance sheet is off. And, it goes far beyond bad forecasting.

Wasted time

time spend of staying on top of their accounts payable balance sheet was slashed from 8 hours to 20 minutes on average once they streamlined their workflow with Order. This represents a 96% reduction in time spent in that area so they could focus on attending to more important matters.

Reputation damage

While reputation is everything regardless of the business, a small business relies on this much more than a larger business. Why? Because most new small business customers come from word-of-mouth referrals. If word gets out that your small business is 'cooking the books,' customers may view that as a sign that your business is not trustworthy.

But it's not just your reputation with customers that's on the line. Inaccurate financial statements could mean traditional lenders turn you down or offer unfavorable payment terms for loans. Is potentially restricting access to the working capital you need to grow worth the risk?

Lastly, if your company issues statements of earnings to shareholders, you're really not going to want to have to say the company made significant errors. Issuing restatements that correct errors will cast doubt on your company's ability to get things done right.

Potential legal violations

A flawed accounting system can lead to serious headaches with more than just your shareholders and lenders. If your financial statements falsely convey an inflated valuation, you may find yourself in hot water with regulatory bodies. This is perhaps the number one reason to ensure you're always on top of bookkeeping issues and have accounts payable balance sheets you can trust.

Reduced valuation

If you're creatively managing your current assets to reduce your valuation, this could harm your ability to secure the working capital you need to grow in the future. Inflated current liabilities could make it appear as though your company is deeper in debt than it really is. An erroneous cash flow statement screams that you lack liquidity.

Poor spend management

An often-overlooked drawback of an inaccurate accounts payable balance sheet and other financial statements is that it can increase your debt levels unnecessarily. Unfavorable payment terms for loans, increased cost of goods sold, and inaccurate liquidity are all potential side effects of bad bookkeeping. Additionally, your reports will contain erroneous data that skews quarterly performance metrics or how actual spending compares to the budget.

Faulty ROI results

One of the most powerful arguments for automating your AP process is to capture the transformation's ROI accurately. You can evaluate the returns from accounts payable automation through measurable cost reductions and rebates. It is one reason why the results will be evident much sooner than most other forms of technological transformation happening across businesses today.

Streamlining spend management

Whether you have a new company that is just getting started or an established company looking for ways to integrate automation with legacy technology, you must make a solid plan to streamline your spend management and improve your accounts payable balance sheet processes. Using automated end-to-end financial tools will help mitigate the risks involved with manual, flawed accounting systems.

At the absolute minimum, your AP department should be looking for these features:

- Templates for commonly ordered products

- Tools that reduce labor spend on account payable and accounts receivable reconciliation by a number of days every month

- Ways to capture discounts by paying before the due date

- Tools that lower the cost of goods sold and office supplies by helping you negotiate better deals

- Ability to boost transparency company-wide

- Tools to increase liquidity and working capital

- Reports and dashboards so you can see current liabilities, total liabilities, cash flow, due dates, your accounts payable balance sheet, and other financial metrics in real-time

That is where Order.co comes in. Recruiting new talent, exploring new markets, and maximizing purchase power all depend on transparency in your financial data. Greater accuracy from the accounting department will give your finance team the tools they need to make more informed plans for growth. Seeing the big picture is impossible when pieces are missing.

None of the risk, all of the reward

We understand the challenges you face when running a lean and agile business. Internal and external stakeholders may be hesitant to change established accounts payable balance sheet and spend management processes. Concerns about ROI, integration abilities, and ease of adoption can be at the top of the concerns list.

But these concerns are exactly the reason Order.co is different from other spend management platforms. The return on your investment starts rolling in from the very start because there is no initial investment. Our strategic partnerships lift the responsibility of integrations off your shoulders and onto ours. Once it's customized to your business' needs, adoption is as simple as point and click. Schedule your free demo today!

Get started

Schedule a demo to see how Order.co can simplify buying for your business.

"*" indicates required fields

Sourcing and procurement get used interchangeably. While this isn’t totally accurate—in many respects, they’re not that different.

Larger organizations break these processes into separate departments, with procurement and sourcing functioning as linked activities. At smaller organizations, where these disciplines may not have dedicated departments, stakeholders often consider sourcing and procurement as one. Sourcing is seen as a subset of procurement.

While the similarity between these activities is often blurred, the principles of sourcing and procurement are both essential to minimizing costs and risks in purchasing. Both allow businesses to maximize their ROI.

Instead of focusing only on how the two activities differ, it’s valuable to understand how they should be used in tandem to maximize their mutual benefits.

This article will cover the differences and similarities between procurement and sourcing by:

- Defining procurement, sourcing, and purchasing

- Exploring the difference between sourcing vs. procurement

- Explaining the fundamental value of these processes

- Revealing how technology enhances sourcing and procurement

Download the free ebook: The Procurement Strategy Playbook

What is the difference between sourcing and procurement?

The terms procurement, sourcing, and purchasing are often confusing for stakeholders. While interconnected, these three terms refer to distinct activities and stages within the overall process.

What is procurement?

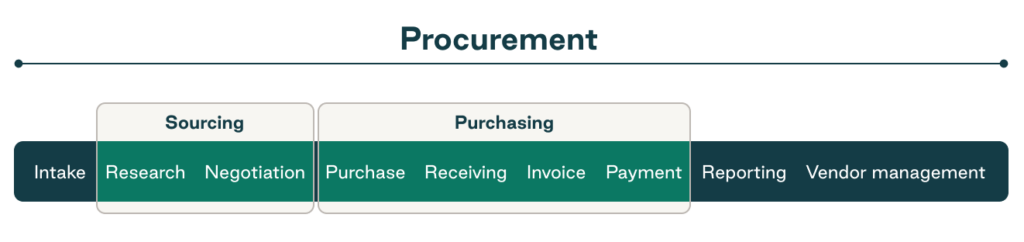

Procurement is the overarching set of processes and activities a company undertakes to find, purchase, and pay for goods and services. It follows the procurement cycle of a purchase from the point of needs identification through supplier selection, negotiation, purchase, three-way matching, payment, vendor management, and reporting.

What is sourcing?

Sourcing is a component of the total procurement process. It begins after needs identification and intake and before the purchasing stage of procurement. It refers to selecting potential vendors to meet company needs when buying a product or service. Sourcing involves examining a list of potential vendors, conducting due diligence on each, and selecting the best vendor for your business based on a criteria list.

What is purchasing?

Purchasing is the portion of procurement that occurs after sourcing activities are completed. It entails ordering, receiving, and meeting payment terms for procured goods and services. Sourcing and purchasing are two main stages of the procurement process.

Does the distinction between sourcing vs. procurement matter?

Ultimately, the goal of the sourcing process is to improve risk management, reduce cash leaks, and enhance the purchasing process so businesses can maximize their procurement goals to maximize ROI.

The logistical differences between sourcing and procurement aren’t as important as their combined potential. Both are strategic.

Unlike the purchasing process (a tactical approach to acquiring and paying for goods), sourcing includes a formal process for identifying and vetting potential vendors. It offers the strategic outcome of reducing risk for the business through:

- Development of search criteria and sourcing policy

- Vendor shortlisting and vetting potential suppliers

- Producing RFP/RFQ documentation

- Implementing sustainability and diversity standards

- Risk matrix assessment and security questionnaires

- Improving resilience and supply chain management

Procurement represents the broader methodology for sourcing and acquiring goods, including:

- Establishing purchase request and purchase order approval

- Setting procurement policy and budget guidelines

- Implementing technology for procurement processing

- Conducting spending analysis and data reporting

- Creating procurement project roadmaps

- Negotiating pricing and contract terms

- Conducting supplier performance analysis

Thus, even if sourcing and procurement are performed across separate departments, the two teams should work closely together. After all, a sourcing department’s goal of reducing costs and risk directly affects the procurement department’s goal of maximizing ROI and vice versa.

Using sourcing best practices to improve procurement

Ultimately, sourcing is only effective when conducted within a strong procurement function. For instance, you require a buyer or organization needs analysis before sourcing begins. That way, you aren’t duplicating resources across the business or investing in products with low ROI.

You need effective purchasing and contract management after sourcing ends so your business receives the products it set out to acquire—on time and without errors.

Conversely, a successful procurement process relies on a strategic sourcing process. Strategic sourcing is the foundation of the procurement operation. It’s how companies can identify opportunities for cost savings and mitigate potential risk.

How sourcing improves procurement and maximizes ROI

Strong sourcing practices greatly improve a company’s ability to achieve its goals and return better results. These results are further enhanced when companies take a sustainable approach to their sourcing.

In the years to come, sustainable sourcing will become imperative for procurement teams. According to McKinsey, the fashion industry already considers this discipline a “must-have,” as consumers show increasing allegiance to clothing brands that are committed to social and environmental causes.

In fact, 56% of CPOs in McKinsey’s Apparel CPO Survey 2019 agreed that “responsible and sustainable sourcing is considered a key strategic part of doing business, as is apparent from its position as a top 10 priority on the CEO agenda today.”

Ethical and sustainable sourcing is easier than it sounds. Sourcing teams should look at the business practices of first-tier suppliers and downstream suppliers, Verónica H. Villena and Dennis A. Gioia, professors at the Smeal College of Business, wrote in Harvard Business Review. These best practices lead to overall better and more impactful sourcing.

How Order.co makes sourcing and procurement work for your business

Sourcing is an essential component of a procurement strategy. That’s why Order.co's procurement software offers vendor relationship features and strategic sourcing tools that help finance and procurement professionals optimize their procurement and sourcing strategy. It helps procurement implement good budgetary controls and maintain total visibility into the process.

Here are a few Order.co features that make sourcing and procurement easy:

- Purchasing through preferred vendor lists

- Real-time visibility into spending

- Procure-to-pay and single-click payment features

Our platform allows each customer to identify strategic savings opportunities across more than 3,000 vendors. At the same time, Order.co helps streamline many logistical aspects of purchasing—such as submitting orders, bundling like purchases, and tracking deliveries. To learn more, schedule a demo with a member of our sales team.

Get started

Schedule a demo to see how Order.co can simplify buying for your business.

"*" indicates required fields

When you need to get products or services to make your business run, are you purchasing them, procuring them, or both? The definitions might seem a little hazy.

Though these two terms get equal billing in the acquisition process, knowing the difference between procurement and purchasing (and integrating it into your finance practices) creates a huge impact on the health of your organization and its ability to grow and retain revenue. Good procurement management can be a competitive advantage, especially for organizations intent on growth.

Let’s look at the key characteristics of procurement and purchasing:

- The relationship between procurement and purchasing

- The common activities associated with each of these functions

- The benefits of good procurement and purchasing practices

- How technology can further improve a good procurement process

Download the free ebook: The Procurement Strategy Playbook

What is the relationship between procurement and purchasing?

Though the two terms are often used interchangeably, procurement and purchasing refer to two different interconnected business concepts. While both are important functions in the materials acquisition process, it is important to clarify the relationship between the two.

Purchasing refers to the process of buying and paying for the products, raw materials, and services necessary to run a business. In most cases, purchasing is initiated by stakeholders searching for solutions to their work challenges. Ideally, purchases go through an approval process before funds are committed. Purchasing is a subset of procurement.

Procurement refers to the strategic, multi-step process a company follows to obtain supplies and services. The procurement function encompasses the entire buying process within a company, from finding the right suppliers to ensuring timely and correct payment of vendors.

Some common tasks procurement teams perform include the following:

- Planning a corporate strategy for buying

- Identifying short-term and long-term goals

- Assisting with budgeting and forecasting research

- Sourcing and evaluating potential suppliers

- Negotiating deals with suppliers

- Administering the purchasing and payment process

- Conducting spend analysis and reporting

While both purchasing and procurement are important functions for the organization, they involve different activities and should be considered separately when discussing spending activities within the company.

Key procurement activities

Procurement teams help plan and regulate spending within an organization using a systematic process and techniques to ensure cost efficiency, maintain product quality, streamline logistics, and plan future improvements. Following are some of the most common procurement techniques for achieving these goals.

- Needs analysis: This is an audit of a business’s internal needs, often with the goal of identifying inefficiencies. For example, if two departments need the same supply or service, it would be inefficient to purchase them separately.

- Due diligence: Due diligence is research on a vendor or supplier’s business model, code of ethics, client history, client reviews, etc. It should also include market analysis and thorough competitive analysis.

- Contract negotiation: It is necessary to create a legally binding agreement between a business and its supplier or vendor. The goal of this document is to outline a long-term partnership that will be mutually beneficial for both parties.

- Strategic sourcing: Sourcing supplies in bulk or bundled with other products reduces their individual costs.

- Supplier and vendor management: Supplier relationships and contract management require routine maintenance. This includes, but is not limited to, order information, delivery tracking, evaluation and receipt of goods, supply chain management, logistics, pay processes, and continuous vendor performance analysis.

- Spend data and analytics: This technique entails gathering metrics and analyzing spend and supplier performance. The goal is to identify spending inefficiencies or determine where there is room for improvement in vendor relationships.

Purchasing as a part of the procurement process

Purchasing is the portion of the procurement cycle that deals with buying and paying for goods and services. It begins at the point of creating a purchase order (PO) and follows a predictable workflow of PO transmittal, fulfillment, invoicing, and payment.

Purchasing is a cross-departmental activity, so adhering to a formal purchasing process is important. A typical firm with 100–500 employees has an average of seven stakeholders involved in B2B purchasing decisions, according to the Gartner Group. These stakeholders may include the original employee making the purchase request, department heads, legal, IT, security, C-suite members (who may seek involvement in big-ticket purchases), and members of the finance and procurement teams. In the absence of good systemic controls, problems such as unnecessary spending and difficulty in tracking and analyzing spend are apt to flourish.

Poorly controlled purchasing exposes businesses to cash leaks when they do not have safeguards against things like maverick spending, poor due diligence, and accidental orders. It also puts business continuity, reputation, and data security in jeopardy if employees don’t follow the appropriate steps to mitigate these risks.

Finally, the lack of visibility created by uncontrolled purchasing can mean chaos for accounting departments. It leaves these teams responsible for processing a sea of invoices and expense reports with no clear access to information with which to efficiently complete the purchasing process.

Why is procurement management important?

An effective and well-controlled procurement process is the antidote to haphazard spending. It creates controls and systems of accountability that safeguard against cost inefficiencies and risk. It also allows your organization to take a proactive versus reactive approach to spending.

Reduces operating costs: Effective procurement takes a strategic, organization-level approach to buying that reduces operating costs. Organizations that build their procurement strategies well can realize significant savings every year. In 2021, the average procurement team anticipated nearly 8% in savings for their organization.

Improves negotiating outcomes: Contract negotiation and strategic sourcing are two main drivers of bottom-line savings. A well-negotiated contract establishes purchase and payment terms that are mutually beneficial to both parties. Many vendors will agree to lower prices in exchange for longer-term contracts because guaranteed revenue allows them to make more accurate business forecasts. A well-designed procurement process aids contract negotiation by increasing visibility for all stakeholders.

Aids strategic sourcing: Strategic sourcing involves using well-vetted, preferred suppliers for all your purchasing needs. It may also involve bundling orders, which allows businesses to eliminate the need for repeated compliance checks and associated paperwork. Building a streamlined sourcing practice creates cost savings, simplifies purchasing, and improves the quality of goods obtained.

Reduces risk: Good Procurement practices reduce risk by building controls around the purchasing process. These risks, such as fraud and data security breaches, can generate significant expense and affect every company—from small businesses to huge enterprise organizations. For context, PwC’s Global Economic Crime and Fraud Survey showed that the costs of ransomware and breach incidents among their 2020 respondents totaled $42 billion in damages.

Enables effective due diligence: Due diligence is the primary procurement process that guards against risk. Conducting due diligence ensures that purchasers are evaluating any potential source of risk before they commit to a supplier or vendor. Taking the time to vet every supplier and deal pays continuous dividends.

A well-implemented procurement process addresses many aspects of the potential supplier’s business practices, from corporate values to the quality of its products and services. By ensuring that a third-party vendor or supplier aligns with their own values, procurement teams reduce reputational risk. Verifying the quality of products and services reduces the likelihood of late deliveries, wrong orders, and unusable items—thereby reducing risk to business continuity.

Implementing better procurement and purchasing

Effective procurement offers improvement for companies of every size and stage. Many large manufacturing companies have robust procurement departments that handle every step of the procurement process. But you don’t need a dedicated procurement professional to employ this approach to spending. Even CFOs and COOs at small companies can employ the basic principles of procurement to reduce their operating costs and risks.

5 Easy steps to implement procurement controls

Using these simple steps, finance teams can get better control of purchasing in order to optimize spending and reduce unnecessary costs:

- Evaluate current spending practices across the business. Look across departments and geographies to identify all operating spend. This should include your office supplies, hardware, software, equipment, cleaning supplies, etc.

- Identify opportunities for cost savings. For example, if two departments are purchasing the same item or service, you may be able to buy this item or service in bulk for a discounted price. You can also negotiate a contract to achieve the same goal.

- Create controls around future purchasing. One way to do this is to set parameters for what can be purchased and from whom based on user profile, department, location, or authorization level. These parameters can be established by centralizing purchases within preferred vendor platforms or a vendor management system.

- Establish a system for approval and reimbursement workflows that ensures transparency across the organization. Include all relevant departments (e.g. security, IT, legal, and finance) in the approval process.

- Implement a vendor selection policy that allows your team to evaluate vendors on an ongoing basis. This will ensure that the vendors you work with align with your business’s needs, goals, and core values in both the short term and the long term.

Simplify purchasing and procurement with technology

A well-executed procurement strategy benefits organizations in many ways, but trying to accomplish procurement controls manually is a time-consuming and cumbersome process.

Fortunately, technology can reduce much of the manual labor involved and bring additional cost savings. In fact, a Boston Consulting Group study found that companies using digital tools like procurement software decreased their annual expenditures by an average of 5% to 10%.

A procurement management system like Order can automate many tasks in the procurement process. The platform reduces manual labor for many activities:

- Comparing costs across vendors

- Creating purchase requisitions and POs

- Routing purchasing approvals

- Tracking and reconciling deliveries

- Organizing invoice and payment data

All of these tasks are handled within a single centralized database, greatly improving transparency in the spending process across every level of an organization.

To ensure the success of your procurement management, it’s important to identify the best procurement management software for your company’s needs and goals. We’ve created this Procurement Technology Decision Matrix to help you select the best fit for your business.

Get started

Schedule a demo to see how Order.co can simplify buying for your business.

"*" indicates required fields