Today businesses are facing unprecedented challenges as global uncertainty and digital transformation disrupt the status quo.

The procurement function has become increasingly complex and your organization's ability to capture value during times of upheaval is critical. How does an organization strategically navigate this whole process?

The first line of defense is having the right knowledge; the second is having the right procurement software to automate and centralize your Purchase-to-Pay processes.

Is your purchase-to-pay strategy weak?

Maverick spend habits are the fastest way to depleting your company's resources needlessly. If your Purchase-to-Pay strategy is weak and undisciplined, it will be impossible for you to experience the benefits of intelligent spend management. Sometimes, being a maverick is a wonderful thing! But, not when it comes to your spending.

What is the purchase-to-pay process?

The Purchase-to-Pay (also called P2P process, Procure-to-Pay, and eProcurement) process integrates fully automated features for purchasing goods and services. Automation of this process can boost cost savings, save time, and increase your procurement visibility. It streamlines the workflow process from requisitioning, purchase orders, procurement, and vendor payment process.

Benefits of automating purchase-to-pay

Purchase-to-Pay is part of a suite of enterprise resource planning (ERP) tools. E-procurement software implements process automation with greater efficiency and accuracy than traditional processes. It emphasizes cost savings and creating more value from your procurement process. Benefits include:

- Improves the invoicing process by using e-invoicing to optimize internal processes.

- Reducing the time spent on processing purchase orders.

- It helps minimize the potential for errors.

- Increase supply chain and internal transparency.

- Electronically exchange documents for saving time and the cost of office and mailing supplies.

- Real-time purchasing data that gives better insights to identify ways to streamline workflow.

- An all-inclusive procurement solution for the accounts payable process.

- Boosts access to working capital and improves cash flow through better decision-making based on the data.

Purchase-to-pay vs. source-to-pay

Source-to-Pay adds an integral step to the Purchase-to-Pay process for automation of the sourcing of goods and services. Using tools such as three-way matching and e-invoicing, Source-to-Pay can automatically check pricing and payment terms from vendors to find the best vendor deals for your business. Combining these two automation processes can significantly improve supply chain management, enhance functionality, and streamline efficiency. Additionally, it will give your organization greater control over the procurement process.

How to identify savings in your purchase-to-pay process

The purchase-to-pay decision matrix

As a cost-saving measure, businesses often employ a matrix-based organizational or project structure that eliminates various departments' barriers. Additionally, it can bring valuable insights from various team members to different areas of the organization. This technique increases your teams' agility and creates a lot of value for the firm compared to silo formations. That is why your organization should apply the same concept to your P2P process.

Procure-to-pay automation technology is key

By automating your purchasing, procurement, and accounts payable processes, your business will reduce redundancies and centralize decision-making. Recent studies by various organizations yielded fascinating insights into how businesses utilize this method to achieve their goals. Some key insights on centralization include:

- Lowering business costs an average of $0.31 for every $1,000 spent

- Average of one day shortened supplier lead times

- Reducing purchase order processing times on average by one hour

- Established greater stakeholder alliances by creating more innovative supplier incentives and relationship models to gain a competitive edge

To take advantage of the many benefits of automating and centralizing these processes, executives will need to focus heavily on deploying a supplier relationship management decision matrix.

Creating a purchase-to-pay decision matrix

For example, if your company implements a P2P process in the finance department, the focus will be on finance processes. If it is implemented for procurement, the focus will be on procurement processes. By eliminating the silo structure of these two teams and opting for a matrix decision-making process, they can better help each other improve processes. Your matrix should include these considerations:

- Qualifications and experience

- Price

- Innovation and complexity

- Risk assessment

- Level of control

- Value

- Competition

- Ability to meet demand

- Delivery Schedule

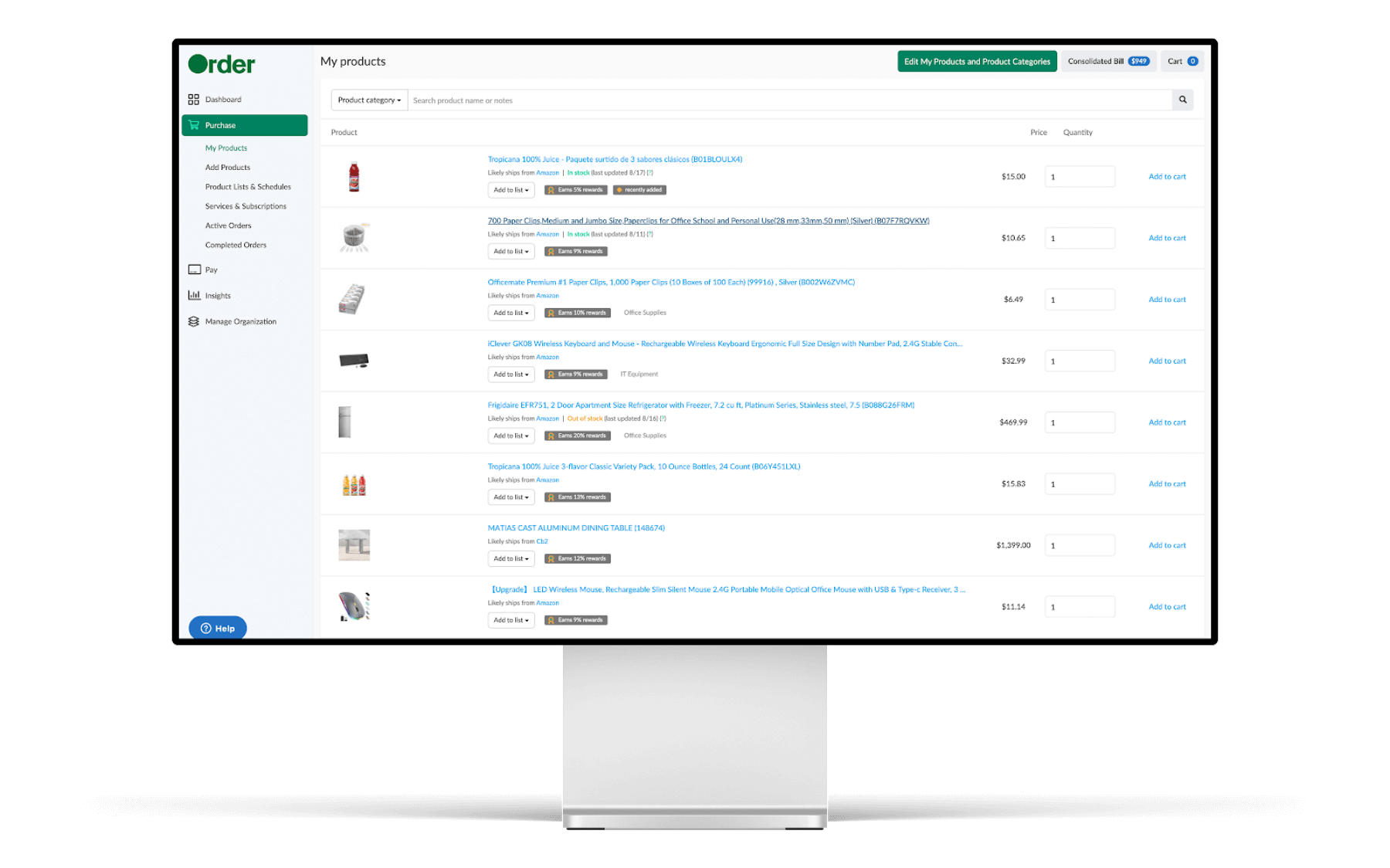

Purchase-to-pay automation with Order.co

Order.co has developed our software to automate many of these considerations to make it simple to compare vendor attributes. Once a decision has been made, you can save time and labor every step of the way. Automating every stage from purchase requisition to your accounts payable allows your team more time to focus on other business processes.

The vendor risk matrix

Understanding the vendor risk matrix can help your company avoid costly mistakes when selecting the right vendors. By taking a more scientific approach to understanding potential risks, you will develop a vendor management policy that incorporates a continual feedback loop for assessing current vendors. But, doing this for each vendor is time-consuming. A company needs to automate this process to maintain a competitive edge.

Avoiding purchase-to-pay pitfalls

Running into snags in the procurement process waste company time and resources; that much is obvious. Sometimes, employees get so busy tending to other business processes that inefficiencies are put on the back burner. And that is exactly where your business will slowly leak money into oblivion. Recognizing and addressing some of the most common hazards to your efficiency will plug those leaks.

Suffering inefficiencies from vendor complacency

The typical procurement involves numerous steps that often lead a business to become complacent with supply chain management. This will inevitably lead to your company absorbing many inefficiencies in your own processes and those of your vendors. Learning how to avoid these pitfalls will ensure your success in optimizing the approval workflow.

Damaged shipments

You will inevitably receive damaged shipments from time to time. If your company paid for shipping, you would likely have to sort out the issue with the shipping company. If the vendor paid, you're off the hook for that part, but you will still need to notify the accounts payable department to avoid paying an invoice in full while sorting out the issues.

Outdated supplier information

It can cause quite a few headaches for the accounts payable department when they realize they have incorrect information for a supplier. This can lead to undesirable disruptions rippling throughout departments across your entire business. By automatically updating the accounts payable department when the purchasing department uses a new vendor, you can easily avoid this common stumbling block.

Hidden costs

One of the biggest pitfalls that an organization can find itself dealing with is vendor negotiation and hidden costs. When your business needs a good or service, it is easy to push the approval workflow to keep your business running. However, with the right procurement software, you can see the total cost of dealing with a vendor upfront. For instance, you will know if you're paying a handling fee, eligible for discounts, and any associated shipping costs. Order.co works directly on behalf of businesses to negotiate the best price on any item.

How to modernize your purchase-to-pay process

If your organization is still doing things the old-fashioned way, the odds are high that you've already fallen behind your competition. By now, you should see how automating your purchasing and procurement processes can increase cash flow, improve supplier management, capture early payment discounts, and much more. As businesses worldwide learn to adapt to a changing landscape quickly, the motto "Disrupt or be disrupted" rings true louder than ever before.

As Deloitte's 2019 Global Chief Procurement Officer Survey outlines, threats to established supply chains, an economic downturn, and managing risk with mega-suppliers are at the forefront of many executives' concerns. In fact, 61% of respondents feel that procurement-related risks have increased over the last 12 months. Adding to these concerns is how quickly talent models are changing and whether procurement teams can deliver on strategy. Confidence in established processes is waning in favor of more agile processes to maintain a competitive edge.

Implementing intelligent spend management processes are an integral part of a successful P2P strategy. Case in point: Cozen O'Connor, a $470 million law firm with multiple locations around the world. The firm often dealt with the inability to see a truly accurate picture of their spending practices. This puts them at a significant buying-power and negotiation disadvantage.

What Cozen O'Connor thought was a convenient process actually ate away at their profits unnecessarily. That is, until they implemented Order.co. Our platform was able to bring the firm 100% spend visibility and save them $60k-$70k per year on the same supplies they were purchasing before. What could your business do with that money?

Rising to the top of the game with purchase-to-pay automation

Order.co offers a streamlined end-to-end Purchase-to-Pay solution to save our clients 20% on purchases. We've paid special attention to crafting procurement software that is easy to use for every member of your team. With Order.co, you will have the tools you need to rise to the top of the accounts payable game. We want to show you the Order.co difference! Schedule a free demo today.

Get started

Schedule a demo to see how Order.co can simplify buying for your business.

"*" indicates required fields

What if you discovered that as much as 2% of your business’s payments are duplicates, charged for the wrong amount, or contain some other error? According to industry survey data, that’s the case for many businesses.

Businesses must ensure their accounts payable (AP) departments verify the legitimacy and accuracy of every invoice they pay. That’s where three-way matching comes in. Companies use this reconciliation method to detect fraudulent invoices, embezzlement, computer glitches, or human error. Then, they can prevent unauthorized payments.

In theory, it’s an entirely valid solution—however, in practice, the process used to implement this cost-saving system often has glaring flaws. For many companies, manually verifying payments is more expensive than just paying the occasional erroneous invoice.

Considering that the entire purpose of three-way matching is to increase payment accuracy and avoid maverick spending, it’s essential to carry it out as efficiently as possible.

In this article, we’ll cover the basics of three-way matching:

- What three-way matching in accounts payable means

- The benefits of a three-way matching process

- How three-way match automation addresses payment accuracy issues without costing more than the problem it solves

- Why the right automation software can provide additional benefits

Download the free tool: Invoice Tracking Template

What is 3-way matching in accounts payable?

In accounts payable, three-way matching is an internal control process that ensures invoices, purchase orders, and receiving reports all have consistent line item details.

The goal of this approval process is to ensure that each invoice is consistent with the products and amounts ordered, as listed on the purchase order. Then, it ensures this matches the goods delivered to the receiving department and listed on the corresponding receiving report.

This AP process guarantees that what is delivered matches the original order every time.

The difference between 2-way, 3-way, and 4-way matching

Two-, three-, and four-way matching are all accounts payable approval processes—however, each version takes the matching process to a different degree.

Two-way matching is the most basic approval process, where the vendor’s invoice number and details are checked against the purchase order (PO) number to ensure that these documents match.

Three-way matching adds the receiving report or receipt of goods as a further verification method.

The most complex, labor-intensive, and time-consuming invoice matching technique is 4-way matching. The supplier invoice is matched against the PO and the receiving report, which is matched to the packing slip or order receipt.

Why should you use 3-way matching?

The main goal of implementing a three-way matching process in your purchasing department is to cut costs. It is a money-saving measure to ensure companies don’t overpay. Three-way matching makes sense for several reasons:

- It eliminates invoice errors. Even if both parties in a deal are careful, mistakes can happen. Supply chain fluctuations may create backorders and substitutions, or manual entry could introduce discrepancies into a price calculation. Three-way matching creates a system of accountability that everyone can benefit from.

- It helps identify fraud. Tying every shipment back to its purchase and invoice documents makes it more difficult for bad actors to move phantom or inflated invoices through the process. It makes spotting these issues easier and creates an audit trail for researching procurement fraud.

- It eliminates double payments. Tying invoices to accounting data creates a clear chain from purchase to fulfillment to payment. By ensuring every invoice has a home, businesses can avoid costly duplication and the time and research involved in seeking a refund.

- It creates confidence in your numbers. Disorganized processes lead to doubt and frustration. By creating a clear internal control for each purchase, accounting and finance teams can trust the numbers they deliver in their reporting, and executive teams can rely on the financial statements created from this data.

Three-way matching has the added benefit of simplifying bookkeeping and audits. With all your historical ordering and matching data centralized, you surface other purchasing insights, refine your reporting process, and get to the bottom of issues and exceptions more quickly.

The real cost of a manual 3-way matching process

Companies that choose to employ three-way matching do so to reduce mistakes, catch illegal activity, and save money. However, with a manual process, even when trying to avoid overpaying, businesses can often end up with much higher processing costs.

Take a look at some findings of a recent study by Ardent Partners regarding AP and invoice processing:

- The average invoice costs $9.25 to process manually

- More than 20% of invoices have exceptions, costing time and money to correct

- Four in 10 (38%) of businesses surveyed reported business fraud within the previous 12 months

Expenses from manual invoice matching could amount to thousands or even millions of extra dollars in processing costs, all while trying to avoid overpayment.

How 3-way match automation can help

Businesses that have switched from a manual procurement process with paper invoices to a completely automated system have seen some unbelievable results. They have more than proven the value and efficacy of automating the three-way matching process.

Take a look at some of the data from businesses that have shifted from manual to automated 3-way matching:

- Savings of 90% on accounts payable costs

- Accounts receivable expenses reduced by nearly half

- Instances of invoice errors reduced by 37%

- Lower invoice processing costs by 29% on average

- Businesses with 10k+ monthly invoices saved $300k

Case studies: 3-way match automation in the real world

While AP automation saves businesses thousands of dollars on manual approval process costs, that’s not the only benefit to automation. The right platform can save you time on needlessly complex procurement processes that eat up your schedule. This allows you to efficiently do more of what needs to be done.

Many businesses have trouble keeping track of which suppliers are approved, where everything was ordered from, and when deliveries are due. Ordering from multiple vendors on different sites and completing several checkout processes can lead to disorganization and confusion. These issues are easily addressed with the right automation solution.

See how the following businesses used the Order.co platform to streamline their workflow:

WeWork: Total visibility and order continuity

The co-working unicorn WeWork faced significant challenges in streamlining ordering and payments across their 800 global office locations. By implementing an integrated ordering and payment system, the company increased visibility into its AP processes and eliminated maverick spending. Replacing their manual 3-way matching with an automated process allowed them to process millions of invoices with ease. This move brought the company better ordering continuity, improved leverage with suppliers, and considerable cost savings.

Zerocater: More process efficiency and fewer invoices

Zerocater had a complex, inefficient, and time-consuming invoicing process. They had limited visibility and little control over ordering. AP had trouble keeping track of suppliers, and they spent days on invoicing. Using the Order.co Chrome Extension, the team could shop anywhere, check out across vendors, and consolidate their invoices. Zerocater now has a much more efficient system, with 50x fewer invoices, freeing up their time to focus on what they do best.

XpresSpa: Vendor compliance and cost savings

XpresSpa had a chaotic list of vendors, products, and carriers, only 70% of which complied with their corporate standards. Using Order.co’s platform, they streamlined their procurement workflow, increased their vendor compliance to 100%, and saved a total of $68,000 in the first year.

Automate your 3-way matching process with Order.co

Three-way matching is a great system when implemented correctly. Using an automated system for your invoice processing, procurement, and other systems saves time, realizes better cost savings, and leaves more energy for accounting teams to perform higher-level tasks.

To automate three-way matching as part of your procure-to-pay process, you need a system with some key functionalities:

- Centralizing order and supplier data into a single platform

- Creating purchase orders directly through the system

- Accepting electronic invoices automatically

- Conducting automatic three-way matching between POs, delivery forms, and invoices

- Automating the invoice approval and payment process

- Reporting on all these activities from within the platform

Order.co gives you one platform for purchasing, vendor management, and automating your AP processes to save you the time and expense of manual data entry and human error.

To learn more about implementing automated three-way matching in your procurement process, schedule a demo of Order.co today.

Get started

Schedule a demo to see how Order.co can simplify buying for your business.

"*" indicates required fields

Making money is the primary goal of any company—but earning is only half the battle. The other half is reducing expenditures that eat revenue. While overhead spending of up to 35% of annual revenue may be considered normal, this percentage is only relevant in relation to net profit. If you’re only looking at 5% profit after all is said and done, you need to rethink your spending strategy.

One of the first areas to look? Identify the inefficiencies in your process. No matter how much money your teams bring in, you can’t outrun a process that’s creating cash leaks.

Download the free ebook: How Automation Can Solve Finance Teams’ Biggest Challenges

Accounts payable (AP) is one of the best areas to start improvements. Traditional AP departments limp along with expensive challenges such as invoice exceptions, data entry errors, ineffective fraud prevention, lost cash, inefficient data storage, and slow processing.

Companies are turning to automated accounts payable procedures to eliminate redundancies and improve organizational efficiency. As of 2019, the AP automation market was worth $1.9 billion—and at a compound annual growth rate (CAGR) of 11%, the sector is projected to reach a valuation of $3.1 billion by 2024.

Demand for controlled user access, which helps reduce payment-related fraud, is one of the primary catalysts for this growth. However, the sector faces challenges such as a lack of awareness of AP process automation and digital literacy skills. As digital literacy and awareness of AP automation increase, the growth will only continue.

In this article, we will look at some key aspects of the AP process:

- How the traditional accounts payable process works

- What an automated accounts payable process looks like

- The benefits of accounts payable automation

What is the accounts payable process?

Business operations are based on the flow of expenditure and revenue within a company. Accounts payable procedures manage the expenditure and purchasing side of things. Their primary function is to ensure company expenses are paid.

The AP process involves capturing data on invoices for all invoice formats (digital and paper), ensuring invoices are coded with the correct accounts and costs, matching the invoices to purchase orders, and processing the payments.

The manual nature of the traditional accounts payment approach increases the risk of human errors, redundancies, and time wasted. With inefficient processes, the procure-to-pay (P2P) cycle can take up to three months.

The consequences of inefficient accounts payable

Disorganization in the accounts payable process can lead to many negative business impacts:

- Fines and late charges

- Vendor relationship challenges

- Employee burnout and turnover

- Supply chain and distribution delays

- Manufacturing and shipping disruptions

- Credit and funding issues

- Cash flow fluctuations

There are also other challenges with manual accounts payable processes:

- Expense reporting and tracking

- Susceptibility to risk and third-party fraud

- Increased spending on AP team wages

- Lack of data visibility

- Communication delays

- Payment exceptions

What does an automated AP process do?

An accounts payable team is responsible for collecting invoices, confirming three-way matching, and conveying payment. Due to the number of stakeholders involved, cycle times for purchasing and payment are usually long and riddled with challenges.

An automated accounts payable process eliminates the bottlenecks. Through automation, your accounts payable department benefits from increased efficiency and accuracy, cost savings, and reduced exception rates.

7 Major benefits of automating your AP process

Change can be hard, but it’s necessary. In a volatile economic landscape, enhancing efficiency in your accounts payable procedure plays a crucial role in your potential growth.

Here are seven key areas where AP automation improves the process:

1. Time savings

Time is money, yet nearly two-thirds of companies are throwing away AP budgets with manual processes. Automated processes make it possible to do more repetitive tasks with fewer AP staff hours. Many tasks can be converted into touchless processes through automation:

- Scanning vendor invoice headers and line-item data using optical character recognition (OCR)

- Routing purchases orders and payables through predetermined business processes

- Handling three-way matching with no human involvement

2. Streamlined invoice processing

Approximately 3.6% of all invoices entered manually have errors or discrepancies. Through automation, your purchasing department can set internal controls that make its AP processes streamlined and accurate, requiring minimal oversight. This increased efficiency comes with several key benefits:

- Virtually no human errors

- Ease of budgeting, sending and receiving reports, and auditing and preparing financial statements

- Reduced risk of overpaid, miscoded, duplicate, or late payments

- Automatic exceptions flagging for invoice approval, review, and reconciliation

3. Greater operational control

With the traditional AP process, it’s easy to lose track of invoices due to miscoded documents or misplaced paperwork. With such limited operational control, business owners end up paying late fees for missing or delayed invoice payments.

Accounts payable software solutions eliminate these challenges in a few ways:

Automation: Creating automated workflows for accounts payable procedures eliminates invoice exception risks. Since everything takes place in the system, losing invoices becomes a thing of the past. The platform handles invoices in the order your team uploads them. The time saved through automation can instead be directed toward other activities that increase organizational efficiency.

Exception handling: With the process improvement that comes with automation, resolving errors in vendor payments is easy and fast. If there is a problem with a particular invoice, the system will automatically flag and reroute it to the appropriate person immediately.

Risk avoidance: Fraud is one of the primary risks of manual payment processes. Identifying fraudulent invoices is an elusive task, as is rectifying them once an incident occurs. A manual system makes it difficult to conduct thorough audits. In an automated accounting system, all the necessary invoice data is in one place. Unverified or suspect payments are easier to identify and investigate.

4. Discounts on early payments

Delays in the accounts payable approval process lead to supplier fines. Conversely, timely payments result in discounts. While 42% of respondents to a recent study cited early payment discounts as a top priority, achieving this objective with a manual process is nearly impossible.

An automated AP process streamlines invoice processing, allowing you to take full advantage of early payment discounts.

5. Integration solutions

Operational efficiency is improved when your procurement function integrates with your larger tech stack. Through integration, accounting can share data with other vital systems such as financial planning and analysis (FP&A) tools, enterprise resource planning (ERP) systems, and other internal databases.

6. Increased productivity

Talent plays a significant role in the success of a company. Organizations look beyond credentials to pursue innovative personnel with leadership qualities that can help steer the business forward.

In building a modern procurement team, creating an environment that maximizes each member’s potential is essential. AP automation solutions remove redundant processes so team members can focus on core business functions to increase revenue.

7. Improved vendor relationships

Delays in the processing and payment cycle lead to difficulties with supplier relationships. An automated accounts payable process improves supplier relationships in several ways:

- Helping you adhere to payment schedules and supplier payment terms

- Enabling invoicing through email, electronic delivery, or paper

- Automating renewals and enabling lifecycle evaluations

Next steps to automating your accounts payable process

An automated AP process benefits you and your suppliers. The AP process is fast and accurate when teams use automated accounting software, saving time and avoiding potential losses from fraud or duplicate payments. For your suppliers, efficiency eliminates delays for accounts receivable. Automation ensures strong, long-term relationships with your most important suppliers.

To learn more about using best-in-class accounts payable automation software to increase operational efficiency, download our Operational Efficiency Handbook.

Get started

Schedule a demo to see how Order.co can simplify buying for your business.

"*" indicates required fields

Procure-to-pay (P2P) is the process an organization uses to source, negotiate, purchase and pay for goods and services. A powerful, effective procure-to-pay (P2P) cycle is critical for your business.

As Forbes Councils Member Peter Nesbitt notes, the way companies spend money has changed dramatically over the past several years. Businesses no longer rely on a top-down model for purchasing and spending. As a result, P2P cycles and technology have changed dramatically.

A well-crafted procurement process is an enablement tool for teams. It reduces friction in the supply chain and speeds the delivery of products to market. But the traditional procurement model—driven by manual processes and limited visibility—is no longer sufficient for driving growth.

Download the free ebook: The Procurement Strategy Playbook

Using technology to optimize procure-to-pay (P2P)

Thanks to next-generation P2P technology, meeting your financial goals and tracking your spending at scale are easier. These systems enable classification and analysis capabilities critical to managing business spending and reducing costs. They reduce value-sapping maverick spending, improve your functionality, and ensure your accounts payable team is focused on the right tasks to create value.

We’ll discuss:

- The components that make up the procure-to-pay process

- Best practices for increasing operational efficiency

- How to implement next-generation technology

What are the steps in the procure-to-pay cycle?

The procure-to-pay process includes all the steps necessary to purchase materials and services for your organization. It begins with a purchase request and follows a predictable (and trackable) path to invoice approval and payment.

The 7 steps of a P2P process:

- Identify needs: In the initial steps of the process, a stakeholder identifies a product or service they need. Depending on the need, they may outline requirements for the procurement department.

- Requisition materials: The stakeholder submits a purchase requisition. Department heads and Finance sign off and approve that requisition so that Finance or Procurement can move forward with the purchase.

- Source the materials: Effective sourcing is critical to ensure that you have a solid supplier who will offer your business the best possible deal on your goods.

- Create a purchase order: Upon approval of the purchase and sourcing, the Purchasing team or stakeholder submits a purchase order to begin the transaction. This is routed to the supplier for fulfillment.

- Receive the goods: Once fulfillment is complete, accounting conducts the three-way matching process to ensure the ordered goods and actual deliveries align. The financial team will ensure that no discrepancies exist that could cause problems with the process.

- Approve the invoice: Once reconciled, Procurement teams approve the vendor invoice for AP processing.

- Pay the vendor: The vendor gets paid for their services based on the terms of the contract. Post-payment, the accounting team may implement contract management and analysis. This is part of the supplier lifecycle management process.

Best practices for your P2P cycle

Rather than just checking the boxes, routing the request, and moving forward without attention to detail, take the time to optimize your P2P process. Ensure the best tools and processes—namely, procure-to-pay software—are in place to manage your P2P cycle effectively.

The best P2P management practices usually include:

- A documented intake or requisition process

- An approval process with a standard list of approvers

- Budgetary review through finance or procurement

- A strategic sourcing program to identify the best suppliers

- Negotiating and contract prerequisites for each purchase

- Purchase order review and shipment reconciliation process

- Centralized vendor payment and contract management

Procure-to-pay software increases the effectiveness of a well-executed purchasing process. It simplifies the overwhelming process of managing the sourcing, purchase, and payment of goods and services.

Using software is the best way to create a scalable solution that grows along with your company. Even better, P2P software often results in net savings well above the investment in automation.

P2P software automates many repetitive tasks that bog down your purchase-to-pay process, including:

- Vendor sourcing and selection

- Purchase requisition and purchase order approvals

- Invoice approval and invoice processing

5 goals to strive for in your P2P cycle

These best practices improve the procure-to-pay process flow and realize better cost savings for your organization. Identifying your desired outcomes of a program—whether its streamlining operations, increasing cost savings, creating scalability, or improving inventory management—helps you make decisions about your program.

1. Increase visibility in your purchasing process

Visibility is critical in tracking the success of your procure-to-pay cycle. It enables your stakeholders to track each purchase through the process. It also creates an audit trail and a source for data reporting.

Order.co provides real-time spend data, coded down the line, product, user, or location level. This data helps your finance team make critical decisions about your purchases. This next-generation visibility—which offers insight into the latest changes in your inventory, availability, and purchases—helps your finance team and other decision-makers see and adjust to changes in your procurement function. It ensures that you’re buying what you need, with competitive pricing and high levels of compliance.

2. Automate the accounts payable department

Automation has become increasingly common across many industries, and the procure-to-pay cycle is no exception. Automating your accounts payable function can result in as much as a 60% increase in productivity and an 83% reduction in purchase order processing time.

Order.co automates many of the steps involved in the P2P cycle. It also helps organizations implement strategic sourcing to ensure the best sourcing for high-volume or high-cost goods. This automated sourcing has helped many clients save an average of 8% on their procurement costs.

3. Use a dynamic system to manage the payment process

Vendor payments are a critical part of your P2P process. Optimizing the payment process with the right workflow reduces payment errors, eliminates time-consuming research and corrections, and ensures payments align with business needs and cash flow.

A dynamic procure-to-pay solution allows businesses to manage payments according to changing business considerations, consolidate payments into a single invoice, and reduce the time spent handling the accounts payable process.

4. Optimize ordering and logistics

Transparency is crucial to maintain effective ordering processes. It ensures you have the right items coming in at the right times.

An effective P2P process helps you optimize your ordering across your organization. It also provides insights into standard pricing, total cost, and other critical metrics for maintaining inventory control without sacrificing cost efficiency.

Order.co allows organizations to order the goods they need across departments or locations, providing continuity and cost efficiency.

5. Coordinate and manage delivery schedules.

Monitoring delivery schedules through an automated notification system helps you better plan inventory receipt and distribution. It also increases supply chain resiliency, allowing the business to respond to changes in availability, delivery status, and quantity without disruption to normal operations.

How technology software enables P2P

Maintaining an effective procure-to-pay cycle with a manual process becomes more complex as the business grows. By implementing technology, you can automate repetitive tasks and reduce the errors associated with processing purchases and tracking deliveries on a spreadsheet.

Using P2P software, businesses can automate much of the process, including:

- Purchase requisition and purchase order creation

- Purchase approvals

- Vendor sourcing and e-procurement

- Delivery tracking and reconciliation

- Three-way matching

- Invoice coding, processing, and approval

- Supplier lifecycle management

Using software to drive the procure-to-pay process also gives your business access to powerful analytics and robust reporting tools that improve the procurement function, save money, and increase efficiency.

Order.co streamlines your P2P cycle

Digital transformation has revolutionized the P2P cycle. With a procure-to-pay solution like Order.co, businesses have the power to implement total spend management, eliminate inefficiencies, and protect the bottom line—all while allowing locations to quickly and easily order the supplies they need. Schedule a demo of Order.co today to get started.

Get started

Schedule a demo to see how Order.co can simplify buying for your business.

"*" indicates required fields

![[eBook] How Automation Can Solve Finance Teams’ Biggest Challenges](https://www.order.co/wp-content/uploads/2022/09/finance-and-automation-ebook-640x480.jpg)