Using Accounts Payable T-Accounts for Spend Accountability

When it comes to your company’s financial health, revisiting the basics can bring new perspectives to current problems. Consider a sports analogy:What do the world’s most famous coaches make their players do in the off season? Practice the fundamentals. Coaches have their teams practice rookie-level drills because it trains their minds and bodies to react with cat-like reflexes. They solidify the fundamentals to the point they're instinctual.

The same concept applies to any profession, whether you’re a novice or an expert. Even if you know the fundamentals, there is a reason for the adage, ‘Use it or lose it.’

That is why we are going back to the basics in this article to re-examine T-accounts.

Download the free tool: Financial Audit Preparation Checklist

What is an accounts payable T-account?

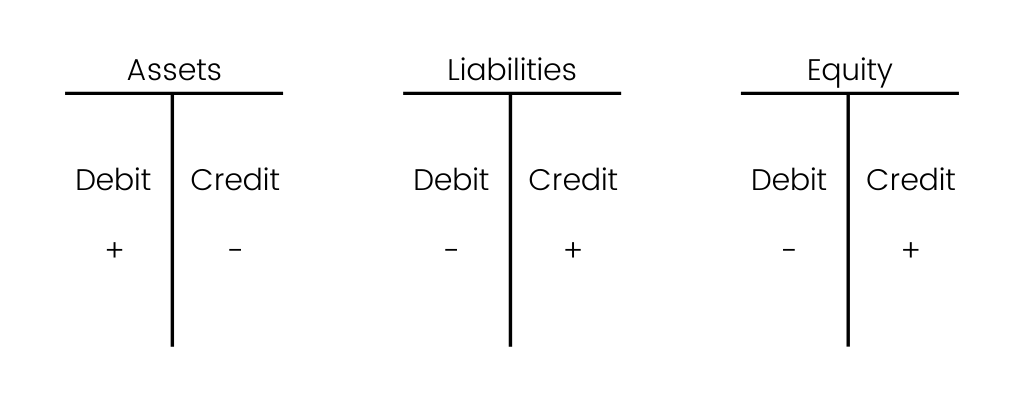

A T-account is named for the visual presentation of double-entry bookkeeping. The left side of the ‘T’ is where a debit is recorded in the general ledger, and the right side is for credits. Each account — whether it’s accounts payable, accounts receivable, payroll, assets, etc. — will have its own T-account setup. The account title sits above the top bar of the ‘T.’

In double-entry bookkeeping, each accounting entry affects at least two of the company’s accounts. When a debit is entered onto the left side of one account, it sends a credit to the right side of another account. The reverse is also true. If you enter a transaction on the credit side in one account, there will be a corresponding entry on the debit side of another account. In this way, debits and credits increase or decrease the corresponding accounts to keep the books balanced.

Examples of accounts payable T-account

T-accounts are a useful visual representation of many types of balance activities. Some common types of T-account representations are:

Assets: Cash transactions, accounts receivable, physical inventory, hard assets like furniture, or technical assets such as computers and phones

Liabilities: Accounts payable, loans, and notes payable

Revenue: Receipt of payment from customers for goods or services

Expenses: Costs incurred to run the business such as rent, supplies, insurance coverage, incidentals, travel, and utilities

Equity: The conversion of company funds into financial instruments, such as shares sold as part of employee stock purchase plans (ESPP) or incentive shares

T-Accounts and their role in accounting systems

The most common method for bookkeeping is the double-entry accounting system of T-accounts. For the balance sheet to be balanced, a business transaction entered into the system must take away from one account and add the same amount to another and vice versa. The most common reason for balance sheet discrepancies is a ledger account entry erroneously placed on the debit side or credit side of the wrong account.

The idea of an accounts payable T-account gets a little confusing for even the most seasoned professional bookkeepers. When using a T-account, you must ensure the correct figure is applied to the correct side of the ‘T.’ It’s common to think of a debit entry as a subtraction to an account and a credit entry as an addition to an account. But this is not always the case:

- Entering a debit (left side) transaction to cash accounts, accounts receivable, or asset accounts like inventory and PP&E increases the account. When you enter a credit (right side) into these accounts, it decreases the amount.

- For the liabilities or shareholders’ equity accounts, debit entry decreases the amount and a credit increases it.

- Income statements also rely on the accuracy of the accounts payable T-account journal entry to reflect accurate figures.

- Accounts that track expense accounts, revenue accounts, gains, and losses use the debit/credit method in the same way as accounts receivable. A debit transaction increases the revenue accounts and a credit entry decreases it. Conversely, a debit will decrease the amount for expense accounts, whereas a credit will increase it.

Case in point: If your business issues common stock, you debit the cash account and credit the shareholders’ equity account to reflect this. But if an employee leaves before their shares are fully vested, they forfeit their shares and you record it as a debit to the shareholder’s equity account and a credit to the cash account.

How do AP T-accounts help spend management?

T-accounts allow a business to easily track its spending. You can see journal entries over a given period of time and view business transactions. But a T-account doesn’t necessarily help your business make wise decisions regarding managing its spending intelligently.

Accounting software tracks your company’s balance sheet and income statements. But it can only give you dynamic figures that provide superficial insight into ways to improve spend management.

The biggest problem with every fast-paced business is identifying areas that are leaking cash unnecessarily. Obvious signs in your financial statements — such as the accounts payable figure being much higher than the accounts receivable — stand out. But without 100% visibility into your spend management, you’ll be left high and dry on how to curb your spending. Worse yet, you may find some balances inflated or deflated, painting a picture that may not reflect reality. Working capital, cash flow, and your bank account suffer as a result.

Streamlining accounts payable

Streamlining your accounts payable and accounts receivable processes may sound like a daunting task, especially when you work with a significant number of vendors. But eliminating maverick spend means finding ways to gain clarity on your company’s balance sheet. Simplifying your procurement process across different accounts with vendors is the first step toward reducing the time spent on the short-term process. This will significantly reduce money spent in the long term.

To help you understand what we mean, let’s take a look at the story of one of our customers, [solidcore]. As a health and wellness company, [solidcore] was expanding quickly with increasing demand for their products and services. In one year, they doubled the number of locations from 25 to 50. With such explosive growth comes a lot of chaos if you’re not properly prepared.

At first, [solidcore] held multiple accounts across multiple vendors and multiple users. Spend tracking was chaotic. The accounts payable department recorded receipts in the general ledger one by one, leading to a backlog. Without a proper purchasing management system, company executives couldn’t get real-time, accurate data on their cash flow, current assets, and expense accounts.

Since implementing Order.co, [solidcore] streamlined a process that once took at least two days and tons of back-and-forth emails for its 25 locations. Today, the process takes about four hours across all 50 locations. Now [solidcore] can see their spending at the product, location, and aggregate levels. With standardized processes steadily implemented in a more reliable manner, the company has much more transparency in its working capital and bank account balance than ever before.

Since implementing Order.co, [solidcore] streamlined a process that once took at least two days and tons of back-and-forth on emails for 25 locations. Today, the process only takes about four hours across all 50 locations.

Use Order.co to streamline accounts payable

Whether refining the fundamentals or digging deep to find innovative ways to streamline your accounts payable process, expertise requires your eyes to stay on the prize—but on potential hindrances, too. The figures on your company’s financial statements tell only a small part of the story even though they reflect the bigger picture.

Using the Order.co platform, many basic tasks such as reporting and visualization, invoice reconciliation, and spend analysis happen automatically within the platform. It takes the guesswork out of managing spending across locations and gives accounting professionals granular insight into every dollar flowing into and out of the organization.

Order.co offers growing businesses the most comprehensive and user-friendly accounts payable management & automation available. We invite you to request a free demo to learn more.

Get started

Schedule a demo to see how Order.co can simplify buying for your business.

"*" indicates required fields